2025 Offseason In Review Series

Here are PFR’s breakdowns of each NFL team’s 2025 offseason.

AFC East

AFC North

AFC South

AFC West

NFC East

NFC North

NFC South

NFC West

Offseason In Review: Cleveland Browns

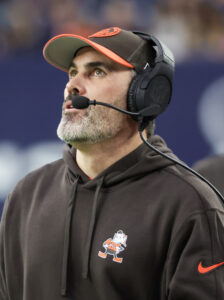

It had been a while since the Browns had felt the lows felt in 2024. Since Cleveland drafted Baker Mayfield No. 1 overall in 2018, the team had either hovered around .500 or made the playoffs in every season. After one such playoff berth in 2023, an effort at back-to-back winning seasons for the first time since 1988 and ’89 produced a 3-14 campaign and brought Cleveland crashing back to Earth. Continued struggles and injury issues for Deshaun Watson and a trio of backup quarterbacks resulted in the league’s lowest-scoring offense and lowest win total.

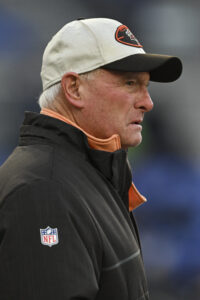

Kevin Stefanski hasn’t, somehow shockingly, become the NFL’s ninth-longest-tenured head coach for no reason, though. Following a season of turmoil, change was a certainty. So many contradictory headlines flew out of Cleveland this offseason concerning so many different, important decisions — such as the future of the team’s defensive MVP or its four-way battle under center — that anything became possible. Fans won’t end up caring much about how many statements general manager Andrew Berry and Co. walked back, as long as the moves made this offseason lay a path forward for success.

Extensions and restructures:

- Agreed to four-year, $160MM extension ($88.8MM guaranteed) with DE Myles Garrett

- Restructured QB Deshaun Watson‘s contract, freeing up $36.8MM of cap space

- Removed year from RT Jack Conklin‘s deal to create nearly $7MM in cap space

- Restructured G Joel Bitonio‘s deal to open up $2.4MM of cap room

- RB Jerome Ford took pay cut, clearing $1.7MM in cap space

Closing in on the final weeks of the franchise’s worst season since the winless 2017, one of several large stories in Cleveland’s offseason began as the team’s defensive star questioned its long-term plan. Seeking answers from the top brass on how they would dig themselves out of this hole, Garrett dangled the threat of a trade request that would set the stage for the two-month saga.

Berry tried to calm the waters, assuring fans he had no plans on trading the former No. 1 overall pick and that his expectations were for Garrett to eventually retire a Brown. A conversation between the two seemed to build some goodwill, with Garrett coming away from the meeting posing the issue of how they might best capitalize on all the talent surrounding him on the team right then.

Part of Garrett’s concern also centered on him having outplayed the five-year, $125MM contract he had signed in 2020. The threat of a trade request began to shift from concern for team success to concern for a new contract. With two years remaining on the four-time first-team All-Pro’s deal, Berry had to judiciously tell the media something was in the works without promising a new contract, at the same time continuing to assure fans that he did not intend to trade Garrett.

At that point, Garrett abandoned any pretense about team success and requested a trade, asserting that an aggressive offseason from the front office would no longer do anything to quell his trade interest. Not a day later, teams were calling. Offers including more than a first-round pick were rumored as part of a would-be blockbuster.

Realizing Josh Sweat was likely to price himself out of Philadelphia, the reigning champs had Garrett on their radar. While the Eagles’ interest was very real, Buffalo, too, was having visions of pairing Garrett with young pass rusher Greg Rousseau as an upgrade over an aging Von Miller. But the Browns did not relent on their intent to retain the future Hall of Fame edge rusher.

Garrett consulted with basketball star LeBron James — someone quite famous for his own dramatic departure from Cleveland — and saw teammate Denzel Ward throw in his support with a similar questioning of his own future with the team. Cleveland’s front office was scrambling to figure out an offer, but Garrett had landed on a decision that he was no longer open to an extension.

Garrett consulted with basketball star LeBron James — someone quite famous for his own dramatic departure from Cleveland — and saw teammate Denzel Ward throw in his support with a similar questioning of his own future with the team. Cleveland’s front office was scrambling to figure out an offer, but Garrett had landed on a decision that he was no longer open to an extension.

Multiple executives from around the league became convinced that the drama had to end in a trade, but at the Combine — a popular place for team decision-makers to have unofficial conversations — no negotiations were entertained by Cleveland. In fact, when Garrett requested to meet with Jimmy Haslam to facilitate a change of scenery, the 71-year-old owner declined the meeting, seemingly putting the saga at an impasse.

If one thing can help someone forget all the reasons they said they wanted to leave, though, it’s a four-year, $160MM extension with $123.5MM guaranteed in total. It’s unclear how discussions continued, how the offer was delivered, what the Browns promised they would do to change the outlook of their franchise; regardless, Garrett insisted that his eyes were opened, his confidence in the team’s plan had changed for the better, and it had nothing to do with money.

Speaking of money, despite holding an NFL second-best $41.95MM of salary cap carryover from 2024 and seeing yet another large salary cap increase, Cleveland entered the offseason $30.17MM over the cap for 2025. The figure was the second-worst in the league, with only the perpetually cap-strapped Saints in bigger trouble. The Browns had a few options to get to a better area cap-wise; again reducing an albatross cap number became the most obvious place to start.

Watson had suffered a setback on his road to recovery from a torn Achilles, as a second tear of that tendon occurred. The Browns went to the Watson restructure well again, continuing to lower record-setting cap hits on the QB’s fully guaranteed deal. This one converted $44.7MM of base salary into a signing bonus and added a third void year to the end of his contract. Even after taking $36.8MM off his cap hit, Watson’s $35.97MM figure in 2025 sits as the 12th-highest in the NFL.

Watson had suffered a setback on his road to recovery from a torn Achilles, as a second tear of that tendon occurred. The Browns went to the Watson restructure well again, continuing to lower record-setting cap hits on the QB’s fully guaranteed deal. This one converted $44.7MM of base salary into a signing bonus and added a third void year to the end of his contract. Even after taking $36.8MM off his cap hit, Watson’s $35.97MM figure in 2025 sits as the 12th-highest in the NFL.

The Browns also put in an insurance claim that could net a further credit to their cap sheet based on the injuries occurring within a time frame set up in a contractual addendum; they received credit off a $13.9MM portion of Watson’s salary in 2024, and the credit for 2025 would be based off a portion of Watson’s original $46MM salary for the year.

An additional $7MM of cap relief came from allowing Conklin to reach free agency at the end of this season, a year earlier than intended. Conklin’s reworked agreement gave him a $10MM 2025 salary with $9MM guaranteed. $2MM of potential incentives could slightly take away from his cap relief, retroactively.

The Browns’ longest-tenured player, Bitonio decided to play another season after briefly considering retirement. The 12th-year guard signed a restructured deal that converted a $3MM roster bonus into a signing bonus and added $600K to each of the four void years following the expiration of his contract.

Notable losses:

- Jordan Akins, TE

- Nick Chubb, RB

- Michael Dunn, OL

- Mike Ford, CB

- D’Onta Foreman, RB

- Nick Harris, C

- Jordan Hicks, LB (retired)

- James Hudson, T

- Charley Hughlett, LS (released)

- Germain Ifedi, T

- Rodney McLeod, S

- Elijah Moore, WR

- Ogbo Okoronkwo, DE (released)

- James Proche, WR

- Juan Thornhill, S (post-June 1 cut)

- Dalvin Tomlinson, DT (post-June 1 cut)

- Jedrick Wills, T

- Jameis Winston, QB

- Bailey Zappe, QB

Another way the Browns figured they could shed some unwanted cap hits was with a series of strategic cuts. By designating the releases of Thornhill and Tomlinson as post-June 1 cuts, the team was able to open up nearly $10MM of cap space. Thornhill was set to hold a $5.68MM charge on the books; his release provided the team with $3.4MM of relief. Tomlinson would have represented $17.15MM in dead cap had he been released without the designation; with it, the team saved $6.41MM of cap space.

Similarly, the release of Okoronkwo resulted in $3.67MM of cap savings, while a heartfelt goodbye to Hughlett opened up $1.08MM more. The Browns had tried shopping Okoronkwo in an attempt at cap relief and perhaps a bit of compensation in return, but the 30-year-old had already been designated as a cut candidate — alongside defensive tackle Shelby Harris, who remained on the team in lieu of $1.68MM of cap relief — and ended up being cut as expected.

Similarly, the release of Okoronkwo resulted in $3.67MM of cap savings, while a heartfelt goodbye to Hughlett opened up $1.08MM more. The Browns had tried shopping Okoronkwo in an attempt at cap relief and perhaps a bit of compensation in return, but the 30-year-old had already been designated as a cut candidate — alongside defensive tackle Shelby Harris, who remained on the team in lieu of $1.68MM of cap relief — and ended up being cut as expected.

Part of the solution to the team’s quarterback issues in 2024, Winston expressed desires of re-signing. With hopes of creating a better quarterback situation for the future, the Browns opted not to pursue another contract with Winston.

Chubb, too, expressed a desire to stay in Cleveland in the early days of the offseason, but there were no immediate plans for the team to re-sign the four-time Pro Bowler. By May, Chubb remained unsigned, and though Berry wouldn’t rule anything out, there was still little likelihood that Chubb would end up with a new Browns contract. In the days before the draft, there were a few internal discussions about a possible return, but a decision was clearly made that resulted, instead, in the team drafting two rookie backs.

The loss of Moore is an interesting one because the Browns placed a UFA tender on him before he signed a deal with the Bills. Buffalo swooped in in plenty of time to prevent Cleveland from getting exclusive negotiating rights, but the Browns will now await some level of compensatory draft pick compensation depending on how Moore performs in 2025. Everybody ends up a winner here as the Browns get their pick, Moore’s potential earnings of $5MM end up being more than his tendered salary of $3.43MM would’ve been, and the Bills add another weapon for reigning MVP Josh Allen.

Wills’ tenure with the Browns ended in a bit of a whimper. The No. 10 overall pick for the team in 2020, the hopeful left tackle of the future had missed 21 games over the past two seasons as injuries began to define his career. With news that he will continue to miss time into the 2025 season, the Browns have moved on, but other teams appear to have shown interest.

Free agency additions:

- Maliek Collins, DT: Two years, $20MM ($13MM guaranteed)

- Joe Tryon-Shoyinka, DE: One year, $4.76MM ($3.48MM guaranteed)

- Cornelius Lucas, T: Two years, $6.5MM ($3.26MM guaranteed)

- Joe Flacco, QB: One year, $4.25MM ($3MM guaranteed)

- Teven Jenkins, OL: One year, $3.05MM ($2.67MM guaranteed)

- Rayshawn Jenkins, S: One year, $1.42MM ($1.17MM guaranteed)

- Damontae Kazee, S: One year, $1.42MM ($1MM guaranteed)

- DeAndre Carter, WR: One year, $1.42MM ($768K guaranteed)

- Jerome Baker, LB: One year, $1.42MM ($718K guaranteed)

- Julian Okwara, LB: Practice squad

After clearing cap space, the Browns were in a better spot but not quite in a place to enter bidding wars over star free agents. Per OvertheCap, Cleveland spent the least amount of money in free agency this year and was one of only four teams to sign 10 or fewer new free agent deals over the veteran minimum.

That doesn’t mean that free agency wasn’t interesting. It was, of course, one of several avenues the team explored in order to fill its quarterbacks room.

That doesn’t mean that free agency wasn’t interesting. It was, of course, one of several avenues the team explored in order to fill its quarterbacks room.

With a number of veteran passers owning Super Bowl experience on the market, Cleveland set a meeting with Russell Wilson and expressed interest in Flacco and Carson Wentz. Though the team appeared serious about pursuing Wilson, its lack of interest in a long-term deal with the 36-year-old hurt its chances of landing his signature. One veteran option fell off the table when Winston tired of waiting for a Browns offer and signed with the Giants, just for Wilson to follow suit four days later.

Falcons passer Kirk Cousins worked to find his way out of Atlanta this offseason, and the Browns were, once again, linked as a suitor. Unable to secure his release, Cousins looked to find a trade partner after the draft. Cousins’ name in connection to Cleveland (and a reunion with Kevin Stefanski) would surge one last time a day before the draft, but Cousins ended up resigning to his fate in Atlanta as the NFL’s most expensive backup quarterback.

Offseason In Review: Cincinnati Bengals

On one hand, the Bengals avoided two major distractions by extending Ja’Marr Chase and Tee Higgins in March. On the other, a franchise regularly involved in money-driven drama ran into two more such issues via the Trey Hendrickson and Shemar Stewart sagas, each dragging deep into summer. However, the club reached resolutions with both defensive ends as well.

Entering the season, the Bengals have a healthy Joe Burrow and an elite weaponry array. The superstar quarterback’s MVP-caliber 2024 season was not enough to drag a poor defense to the playoffs, and questions remain on that side of the ball. The Bengals made a coaching change in hopes of stopping the bleeding on defense, and with Burrow squarely in his prime, considerable pressure exists to avoid a third straight playoff absence.

Extensions and restructures:

- Reached four-year, $161MM extension ($73.9MM guaranteed) with WR Ja’Marr Chase

- Extended franchise-tagged WR Tee Higgins at four years, $115MM ($30MM guaranteed)

- Approved raise for Trey Hendrickson; DE now on one-year, $29MM contract

- Finalized one-year, $5MM extension for C Ted Karras

- Gave P Ryan Rehkow two-year, $2.04MM extension

- Geno Stone accepted pay cut; S now on one-year, $4.9MM contract

- Reduced Cordell Volson‘s 2025 pay; G tied to one-year, $2.6MM ($500K guaranteed)

No real doubt existed about the Bengals’ long-term Chase plans. After college teammate Justin Jefferson set the market last year, Chase would come in ahead of him and continue to thrive with Burrow. Where doubt existed involved Higgins.

Rumors for over a year pointed Higgins to a 2025 exit — via either a tag-and-trade transaction or a free agency defection. But Burrow kept applying pressure on the team to keep his overqualified WR2 in place. Not 15 years removed from their previous star-level QB (Carson Palmer) growing frustrated with a thrifty roster-building approach, the Bengals gave in and enter the season with the NFL’s highest-paid receiver duo.

Rumors for over a year pointed Higgins to a 2025 exit — via either a tag-and-trade transaction or a free agency defection. But Burrow kept applying pressure on the team to keep his overqualified WR2 in place. Not 15 years removed from their previous star-level QB (Carson Palmer) growing frustrated with a thrifty roster-building approach, the Bengals gave in and enter the season with the NFL’s highest-paid receiver duo.

By the July 2024 franchise tag deadline, the Bengals and Higgins had not negotiated in over a year. Last year profiled as a last ride for the Chase-Higgins tandem. While the Bengals rebuffed trade interest in their Chase sidekick after a slow start to the season, a November report revealed there was “little to no chance” the former second-round pick would remain a Bengal in 2025. Weeks later, Burrow went back to work on what became an all-out lobbying effort to convince the Bengals to keep the high-end starter.

During an offseason appearance on ESPN’s First Take, Burrow cited annual cap growth — to the point he referenced the league’s TV deals — as part of his pitch to the Bengals re: Higgins. It is safe to assume Burrow said more behind the scenes, and the effort appeared to crest between the Combine and the tag deadline.

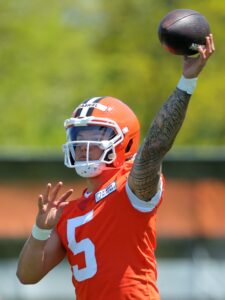

Two years after shutting down Higgins trade talk at the 2023 Combine, Bengals VP of player personnel Duke Tobin said in Indianapolis the team wanted the receiver back at “the right number.” As it turned out, the Clemson alum did much better than he would have had he signed in 2023 or ’24. Fourteen years after Palmer forced his way out via a quasi-retirement threat, the Bengals listened to their quarterback’s pleas and began a process that would keep Higgins in Cincinnati.

Cincy tagged Higgins a second time, irking the receiver. After the sides were far apart on terms in 2023 — when no offer of even $20MM per year came Higgins’ way — real negotiations transpired this spring. Both the Bengals’ WR extensions showed the damage waiting too long on deals can cause, but in the franchise’s defense on Higgins, it did appear 2025 was set to bring a separation. Burrow’s relentless push also showed the power prime-years QBs carry, and it will interesting to see if others follow the Cincy centerpiece player’s lead. Because it brought results.

After not approaching $20MM AAV in 2023 negotiations, the Bengals signed Higgins at $28.75MM per year. While the Bengals kept the deal in line with their preference of no guaranteed salary after Year 1, the team did guarantee a $10MM 2026 roster bonus. Higgins, 26, also will be due a $5MM 2027 roster bonus. But the Bengals can escape this deal with just $7.5MM in dead money in 2027. Higgins will see his 2026 base salary ($10.9MM) become guaranteed on Day 5 of the 2026 league year, providing strong assurances he will be a Bengal for at least two more seasons.

After not approaching $20MM AAV in 2023 negotiations, the Bengals signed Higgins at $28.75MM per year. While the Bengals kept the deal in line with their preference of no guaranteed salary after Year 1, the team did guarantee a $10MM 2026 roster bonus. Higgins, 26, also will be due a $5MM 2027 roster bonus. But the Bengals can escape this deal with just $7.5MM in dead money in 2027. Higgins will see his 2026 base salary ($10.9MM) become guaranteed on Day 5 of the 2026 league year, providing strong assurances he will be a Bengal for at least two more seasons.

Higgins was viewed as a player who could fetch $30MM per year on the open market, and the Patriots — as they have been with just about any remotely available wideout over the past two years — were interested. The 6-foot-4 receiver would have been attached to a $26.2MM franchise tag salary this season and would have hit free agency at 27 in 2026. He almost definitely could have done better by taking that route, but this one will tie the two-time 1,000-yard receiver to one of the NFL’s best quarterbacks in his prime. Chase will also continue giving his older teammate favorable matchups.

All the Higgins departure buzz that emerged from 2023 until early this year was contingent on the Bengals’ plan to prioritize Chase. Jefferson’s contract, however, made a scenario in which the Bengals could avoid future salary guarantees a nonstarter. The Vikings guaranteed their superstar LSU-developed WR $88.7MM at signing. That covered fully guaranteed compensation in two future years. With the exception of Burrow, the Bengals had avoided such commitments. Jefferson’s contract undoubtedly provided a stumbling block as the sides attempted to hammer out a deal before the 2024 season.

By waiting, the Bengals saw the price rise. Chase submitted a triple-crown receiving season, dominating as Burrow returned after his 2023 wrist injury. The cap then spiked by another $24MM. With 2021 receiver draftees Amon-Ra St. Brown, DeVonta Smith, Jaylen Waddle and Nico Collins being extended in 2024, Chase was a lock to come in much higher. And with wideouts and pass rushers suddenly competing to land the top non-QB contract, the Bengals saw their mission become a multifront fight. The Browns’ four-year, $160MM Myles Garrett extension, rather than Jefferson’s 2024 payday, ended up establishing the Chase floor.

By waiting, the Bengals saw the price rise. Chase submitted a triple-crown receiving season, dominating as Burrow returned after his 2023 wrist injury. The cap then spiked by another $24MM. With 2021 receiver draftees Amon-Ra St. Brown, DeVonta Smith, Jaylen Waddle and Nico Collins being extended in 2024, Chase was a lock to come in much higher. And with wideouts and pass rushers suddenly competing to land the top non-QB contract, the Bengals saw their mission become a multifront fight. The Browns’ four-year, $160MM Myles Garrett extension, rather than Jefferson’s 2024 payday, ended up establishing the Chase floor.

Chase, 25, was eyeing $40MM per year before the Garrett windfall surfaced. Seeing as the Bengals were planning all along to pay their top weapon, the Garrett deal — as strange as it looks — crystalized Chase’s price point. The Bengals unveiled their WR extensions on the same night, and Chase’s re-up breaks with team precedent.

Cincinnati guaranteed Chase’s 2026 salary, and the All-Pro secured a rolling guarantee structure. If on the Bengals’ roster on Day 5 of the 2026 league year (which he will be), Chase locks in his $30MM 2027 base salary. The Bengals even threw in a rolling guarantee involving 2028 money; if Chase is on Cincy’s roster by Day 5 of the 2027 league year, $7MM of his ’28 money locks in.

It would have behooved the Bengals to do these deals in 2024, but they have placated Burrow by paying one of the best one-two receiving punches in recent NFL history. That should satisfy their perennial MVP candidate for a while.

Burrow also lobbied the Bengals to extend Hendrickson, doing so at multiple points in 2025. That proved a more complicated situation compared the receiver contracts. On-and-off extension rumors circulated, with intermittent trade buzz factoring into this process. But the Bengals never appeared willing to break with their precedent on future guarantees for a 30-year-old defensive end.

Burrow also lobbied the Bengals to extend Hendrickson, doing so at multiple points in 2025. That proved a more complicated situation compared the receiver contracts. On-and-off extension rumors circulated, with intermittent trade buzz factoring into this process. But the Bengals never appeared willing to break with their precedent on future guarantees for a 30-year-old defensive end.

Even with Hendrickson winning the 2024 sack title by posting a second straight 17.5-sack season, he never received a Bengals offer that included guarantees beyond Year 1. A familiar Cincinnati stalemate ensued as a result.

With Higgins higher in Cincy’s extension queue, Hendrickson received permission to seek a trade just before free agency. The Commanders and Falcons were among the interested teams, but the Bengals naturally set a high asking price. It was believed the team wanted more than a first-round pick for its sack ace. The prospect of paying a 30-something top-market money and surrendering a first-round pick grounded this trade market early, and the eight-year veteran became rather vocal about this Bengals standoff.

From OTAs, Hendrickson said the Bengals had broken off talks; this came after executive VP Katie Blackburn called upon the disgruntled defender to be happy with the offer he had received. We later learned the Bengals never reached $35MM per year — the price Danielle Hunter narrowly exceeded on his one-year Texans bump — and topped out at a backloaded three-year, $95MM proposal. That offer did not include any guarantees past Year 1, leading to a holdout, a hold-in and more trade rumors.

Despite the Steelers guaranteeing T.J. Watt $108MM at signing on just a three-year extension, Hendrickson (who is two months younger) could not secure a comparable offer. The Bengals’ second round of trade talks did not appear to produce anything close to a swap. As was the case in the spring, teams viewed Cincy’s trade ask as unrealistic. This left Hendrickson in a bind. Rather than miss regular-season games in protest — as he had threatened to do — he took the team’s late-emerging raise offer. That will at least pause this drama.

Despite the Steelers guaranteeing T.J. Watt $108MM at signing on just a three-year extension, Hendrickson (who is two months younger) could not secure a comparable offer. The Bengals’ second round of trade talks did not appear to produce anything close to a swap. As was the case in the spring, teams viewed Cincy’s trade ask as unrealistic. This left Hendrickson in a bind. Rather than miss regular-season games in protest — as he had threatened to do — he took the team’s late-emerging raise offer. That will at least pause this drama.

While the Bengals gave Hendrickson a $14MM raise for 2025, they could still use the franchise tag on their top defender next year. It would be a pricey tag (more than $34MM), but the Bengals have both tagged a player on a veteran contract (A.J. Green, 2020) and unholstered a tag on another (Tee Higgins) after reporting pointed to a free agency exit.

It would not surprise to see the organization cuff Hendrickson next year. The ex-Saints third-rounder had signed a one-year, $21MM extension in 2023 in fear of a 2025 tag. It is quite possible the sides’ feud resumes with the Bengals keeping the talented D-end off the 2026 market via the tag.

In lower-profile Bengals extension business, Karras agreed to a one-year deal for a second straight offseason. The veteran center’s one-year, $6MM bump from 2024 had him under contract for this season; his $5MM agreement will extend the partnership through 2026. The Bengals have separated from the other two free agency additions brought in after the 2021 Burrow sack avalanche, cutting La’el Collins in September 2023 and Alex Cappa in March 2025. Karras, 32, has endured.

In lower-profile Bengals extension business, Karras agreed to a one-year deal for a second straight offseason. The veteran center’s one-year, $6MM bump from 2024 had him under contract for this season; his $5MM agreement will extend the partnership through 2026. The Bengals have separated from the other two free agency additions brought in after the 2021 Burrow sack avalanche, cutting La’el Collins in September 2023 and Alex Cappa in March 2025. Karras, 32, has endured.

The third-generation NFLer has started all 34 Bengals games over the past two seasons and has been a starter for the past six NFL campaigns. An ex-Bill Belichick-era Patriots contributor-turned-starter, Karras has two Super Bowl rings. He initially joined the Bengals on a three-year, $18MM pact in 2022. He has outlasted all his O-line mates from that division-winning season and, now on a third Cincy contract, will line up between two newcomers this season.

Volson will not factor into this Bengals season, being placed on season-ending IR after suffering a shoulder injury. The Bengals had demoted the former fourth-round pick late last season and had him on the roster bubble after the offseason pay cut. The 48-game guard starter will head to free agency on a down note.

Free agency additions:

- T.J. Slaton, DT. Two years, $14.5MM ($5MM guaranteed)

- Noah Fant, TE. One year, $2.75MM ($1MM guaranteed)

- Oren Burks, LB. Two years, $5MM ($750K guaranteed)

- Samaje Perine, RB. Two years, $3.6MM ($400K guaranteed)

- Lucas Patrick, G. One year, $2.1MM ($200K guaranteed)

- Mike Pennel, DT. Signed 9/1

- Dalton Risner, G. Signed 8/28

Cutting Cappa opened a starting guard spot. The Bengals are set to use third-rounder Dylan Fairchild at left guard, and they have cycled through unappealing RG options. Patrick and Cody Ford waged a competition during training camp. While Patrick is slated to open the season as the starter, Risner is aboard. And the seventh-year blocker, for all his issues convincing a team to pay him starter-level money, has a history of taking over on short notice.

Cutting Cappa opened a starting guard spot. The Bengals are set to use third-rounder Dylan Fairchild at left guard, and they have cycled through unappealing RG options. Patrick and Cody Ford waged a competition during training camp. While Patrick is slated to open the season as the starter, Risner is aboard. And the seventh-year blocker, for all his issues convincing a team to pay him starter-level money, has a history of taking over on short notice.

After four seasons in Denver, Risner did not see his 2023 free agent market take off. He settled for a one-year, $2.78MM Vikings deal — one that did not emerge until September. Risner moved into Minnesota’s starting lineup after the team traded Ezra Cleveland to Jacksonville. The Vikings did not re-sign him until May 2024, and a pay cut even from the 2023 terms emerged.

Playing on a one-year, $2.41MM pact, Risner started eight games last season. After being activated from IR, Risner finished off a 19-game Minnesota starter run. Pro Football Focus graded the former second-round pick as the No. 22 overall guard last season.

Risner, 30, appeared on Cincy’s radar in April and took an August visit. He did not sign until after the preseason slate. This will apply pressure on Patrick, 32, after beating out Ford for the job. Patrick started 10 Saints games last season, ranking as PFF’s No. 37 guard. He played mostly center in two prior seasons (in Chicago). Risner at least gives the Bengals another option in case Patrick falters; the team will need a patchwork solution while hoping Fairchild can be a long-term answer.

Risner, 30, appeared on Cincy’s radar in April and took an August visit. He did not sign until after the preseason slate. This will apply pressure on Patrick, 32, after beating out Ford for the job. Patrick started 10 Saints games last season, ranking as PFF’s No. 37 guard. He played mostly center in two prior seasons (in Chicago). Risner at least gives the Bengals another option in case Patrick falters; the team will need a patchwork solution while hoping Fairchild can be a long-term answer.

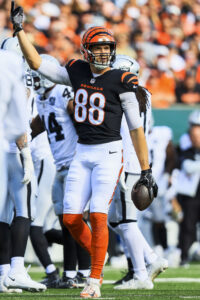

Fant joining Mike Gesicki rounds out what might be the NFL’s best pass-catching corps. Still 27, Fant has six years’ experience as a team’s top tight end. The Seahawks had re-signed him on a two-year, $21MM deal in 2024 but cut him before this past training camp. Fant has two 670-yard receiving seasons (both in Denver) on his resume. To put that in perspective, the Bengals have not had a 670-yard TE season since Jermaine Gresham in 2012.

The Bengals now have two members of the 2019 Broncos’ draft class, but Fant did not prove as good of a fit in Seattle — a team with a deeper receiving corps — as he did in Denver. The Russell Wilson trade component did not eclipse 500 yards in any of his three Seattle seasons. With Gesicki signed beyond 2025, this profiles as a bounce-back opportunity — one he chose after also meeting with the TE-needier Dolphins and the banged-up Saints — for his new backup.

Offseason In Review: New York Jets

2024 was going to be the year. Well, the 2023 season was intended to be the year, but the Jets earned a mulligan for that injury-riddled campaign. So instead, the 2024 season was positioned as the year.

In typical Jets fashion, pretty much everything that could have gone wrong did go wrong. Quarterback Aaron Rodgers showed his age and some rust following his missed 2023 campaign. Robert Saleh couldn’t right the ship on offense, and his once-dependable defense struggled to keep teams out of the end zone before his midseason ouster. Many of the team’s big-name additions, including veterans who were once considered final pieces of the championship puzzle, either struggled or got hurt.

Signs of discontent were evident before they were definitively reported, and for yet another time in the franchise’s history, the Jets were seeking a fresh start ahead of the 2025 offseason.

To the organization’s credit, it’s hard to be too critical of any of their offseason moves. And following a five-win campaign in 2024, there’s really only opportunities to improve in 2025. However, the team’s main offseason moves also seemed to limit their ceiling, both now and going forward.

Coaching/Front Office:

- Hired Aaron Glenn as head coach

- Hired Darren Mougey as general manager

- Hired Tanner Engstrand as OC, Steve Wilks as DC

- Added Scott Turner, Chris Harris as offensive, defensive pass-game coordinators

- Brought in Charles London as QBs coach, Eric Washington as D-line coach

- Hired Rick Spielman as senior football advisor

The Jets moved on from both of their franchise leaders during the 2024 season, with Robert Saleh earning his walking papers in October and Joe Douglas being canned in November. Interim HC Jeff Ulbrich and interim GM Phil Savage never seemed like true contenders for the full-time gigs, and the Jets confirmed that sentiment when they embarked on an extensive hiring process.

The Jets moved on from both of their franchise leaders during the 2024 season, with Robert Saleh earning his walking papers in October and Joe Douglas being canned in November. Interim HC Jeff Ulbrich and interim GM Phil Savage never seemed like true contenders for the full-time gigs, and the Jets confirmed that sentiment when they embarked on an extensive hiring process.

At least 16 candidates interviewed for the head coaching job, with the team extending their search to the college ranks and even to some old friends, including a very public push from old friend Rex Ryan. The team did end up settling on a somewhat familiar face, hiring former first-round cornerback Aaron Glenn to lead their locker room.

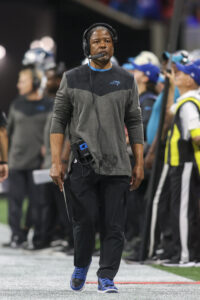

Glenn has been coaching in the NFL for more than a decade, most recently as the Lions’ defensive coordinator. Detroit generally didn’t stand out statistically during Glenn’s first three seasons at the helm, ranking 31st, 28th and 23rd defensively between 2021 and 2023. To Glenn’s credit, he managed to guide the Lions to a top-10 defense in 2024, even after Aidan Hutchinson went down with a season-ending injury in Week 5.

With no head coaching experience and low expectations, it seems like Glenn will have a relatively long leash in New York. Outside of Adam Gase, owner Woody Johnson has generally given his head coaches at least three seasons. Since the Jets may soon be facing another rebuild under this new regime, it would only be natural for Glenn to roam the sideline for several years before his seat gets warm.

With no head coaching experience and low expectations, it seems like Glenn will have a relatively long leash in New York. Outside of Adam Gase, owner Woody Johnson has generally given his head coaches at least three seasons. Since the Jets may soon be facing another rebuild under this new regime, it would only be natural for Glenn to roam the sideline for several years before his seat gets warm.

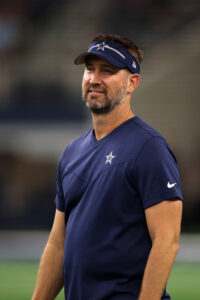

While the Jets have had some stability at head coach, the same can’t be said of their coordinators. On offense, Glenn was tasked with hiring the team’s fourth OC since 2020. He ultimately landed on Tanner Engstrand, who was snagged from the Lions’ coaching tree. The 43-year-old served as Detroit’s pass-game coordinator since the 2022 campaign, a stretch in which Detroit ranked no worse than eighth in production through the air. While he was once assumed to take over for Ben Johnson in Detroit, the Lions made an external hire, allowing Glenn to swoop in and steal one of his former co-workers.

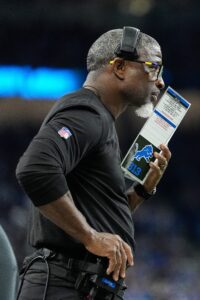

On defense, Glenn added some major experience in Steve Wilks. The veteran coach became a popular name following a successful stint on the Panthers’ coaching staff, but some unsuccessful runs as head coach and defensive coordinator has led to him bouncing around the NFL over the past decade.

Wilks was fired as 49ers DC following an inconsistent showing in 2023 — albeit one far better than what San Francisco produced in 2024 — and he was out of football last year. Now, he’ll be looking to lead a Jets defense that already features some foundational pieces. The former Arizona and Carolina leader’s ability to get the most out of that unit will have the largest bearing on any Jets’ success in 2025.

Wilks was fired as 49ers DC following an inconsistent showing in 2023 — albeit one far better than what San Francisco produced in 2024 — and he was out of football last year. Now, he’ll be looking to lead a Jets defense that already features some foundational pieces. The former Arizona and Carolina leader’s ability to get the most out of that unit will have the largest bearing on any Jets’ success in 2025.

In the front office, the Jets turned to former Broncos executive Darren Mougey. A former UDFA wide receiver, Mougey quickly transitioned to the front office and climbed the Broncos hierarchy. He took over as director of player personnel in 2021, and the following year he was promoted to assistant GM.

Similar to Glenn, Mougey will also be leading a staff for the first time. He brings some pedigree having worked under both John Elway and George Paton, and he was around for Denver’s competitive run with Peyton Manning. However, he continued to rise in the ranks as the organization floundered post-Manning, and while the Jets may appreciate the young executive’s scouting prowess (as the Broncos have recovered following a bleak period), it is a bit curious that they dipped into the Denver talent pool to guide their own front office.

Extensions and restructures:

- Signed CB Sauce Gardner to a four-year, $120.4MM extension ($85.65MM guaranteed)

- Signed WR Garrett Wilson to a four-year, $130MM extension ($90MM guaranteed)

The new Jets leadership didn’t waste any time locking in a pair of franchise cornerstones. Despite some rumblings that Wilson could ask out of New York, the star wideout publicly and then literally committed long-term to the franchise.

The new Jets leadership didn’t waste any time locking in a pair of franchise cornerstones. Despite some rumblings that Wilson could ask out of New York, the star wideout publicly and then literally committed long-term to the franchise.

The extension was an organizational milestone, as it represented the Jets first extension for a former Day 1 pick ahead of their fourth season in the rookie wage scale era. The former 10th overall pick now sits just inside the top five at his position in average annual value, and when considering his age and production, he’s plenty deserving of that accomplishment.

Despite inconsistent QB play through each of his three NFL seasons, Wilson has still managed to surpass 1,000 receiving yards each year. He also hasn’t missed a game, an important factor for an offense that’s once again trying to find it’s identity. Wilson will now work with former college QB Justin Fields, who has not demonstrated consistent accuracy in the pros, but his performance with an erratic Zach Wilson illustrated immediate promise. The Jets will build around their top wideout, as questions about this position group are warranted beyond Garrett Wilson.

One day after extending Wilson, the Jets extended their top defender, giving Gardner a new contract that made him the highest-paid cornerback in the league (although he still trailed Derek Stingley Jr.‘s guarantees by a few million).

Sauce earned high marks for his first two seasons in the NFL. He earned first-team All-Pro honors in both 2022 and 2023 while grading out first and third, respectively, in Pro Football Focus’ positional rankings. The cornerback struggled a bit in 2024, with his yards-per-target number rising from 6.0 to 9.3. Still, the Jets’ front office is clearly banking on that being a slight blip on the radar, and there’s a good chance he returns to his All-Pro ability while playing under a defensive-minded coach like Glenn.

Sauce earned high marks for his first two seasons in the NFL. He earned first-team All-Pro honors in both 2022 and 2023 while grading out first and third, respectively, in Pro Football Focus’ positional rankings. The cornerback struggled a bit in 2024, with his yards-per-target number rising from 6.0 to 9.3. Still, the Jets’ front office is clearly banking on that being a slight blip on the radar, and there’s a good chance he returns to his All-Pro ability while playing under a defensive-minded coach like Glenn.

The cornerback market’s jolt over the past two offseasons has benefited Gardner and Stingley, 2022 top-five picks extended in their first offseasons of eligibility. Going into September 2024, Jaire Alexander‘s $21MM-per-year Packers deal represented the CB ceiling. After Patrick Surtain broke through with a $24MM-AAV accord, Stingley and Gardner bettered the Defensive Player of the Year’s deal after the cap spiked by another $24MM this year.

While the Jets were busy signing those two franchise stalwarts to extensions, they didn’t end up signing some other extension-eligible players. Wilson and Gardner’s 2022 draft mates, first-round linebacker Jermaine Johnson and second-round running back Breece Hall, are still attached to their rookie pacts, while veterans like Alijah Vera-Tucker and Quincy Williams enter the season as impending free agents.

Free agency additions:

- Justin Fields, QB. Two years, $40MM ($30MM guaranteed)

- Brandon Stephens, CB. Three years, $36MM ($22.98MM guaranteed)

- Andre Cisco, S. One year, $10MM ($7.5MM guaranteed)

- Josh Myers, C. One year, $3.5MM ($2MM guaranteed)

- Nick Folk, K. One year, $2.87MM ($1.37MM guaranteed)

- Josh Reynolds, WR. One year, $2.75MM ($2.75MM guaranteed)

- Chukwuma Okorafor, OT. One year, $1.33MM ($757K guaranteed)

The Jets entered the offseason ranked in the middle of the pack in cap space. With anticipated extensions for the likes of Garrett Wilson and Sauce Gardner and the impending cuts (plus dead cap hits) from Aaron Rodgers and Davante Adams, the Jets had to take a more conservative approach to free agency. Still, they managed to add a handful of players who should play roles for the 2025 iteration of the team…for better or worse.

The Jets entered the offseason ranked in the middle of the pack in cap space. With anticipated extensions for the likes of Garrett Wilson and Sauce Gardner and the impending cuts (plus dead cap hits) from Aaron Rodgers and Davante Adams, the Jets had to take a more conservative approach to free agency. Still, they managed to add a handful of players who should play roles for the 2025 iteration of the team…for better or worse.

Most notably, the Jets turned to free agency to solve their QB opening, as the team inked Fields to a two-year deal. With a $20MM AAV, it’s not like Fields’ contract necessarily broke the bank, but it remains to be seen if the front office will see any return on investment. After all, Fields isn’t far removed from a disappointing showing in Chicago that saw him go 10-28 as a starter while achieving a comparable TD rate (4.2) to interception rate (3.1).

To Fields’ credit, he did look better in Pittsburgh last season, guiding the team to a 4-2 record while connecting on five touchdowns vs. only one interception. Still, that showing didn’t stop the Steelers from pivoting to Russell Wilson when the veteran was ready to return. That decision affected Fields’ interest in re-signing with the Steelers, who had prioritized him over their eventual QB move (Rodgers).

Offseason In Review: Baltimore Ravens

Fresh off another disappointment in the playoffs, the Ravens returned to roster-building work ahead of another push at a Lamar Jackson-era Super Bowl berth. For the first time since 2021, Baltimore returned both of its coordinators, and the coaching staff as a whole had significantly less turnover than recent years. Free agency was another situation, as the Ravens’ pricey roster left little cap space to do too much work.

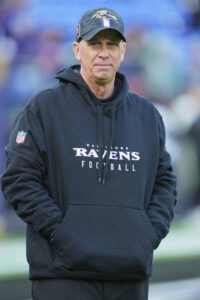

GM Eric DeCosta prioritized the most important of his free agents – left tackle Ronnie Stanley – and let several others walk to collect more compensatory picks in the 2026 draft. The Ravens did add some big names at discount prices in cornerback Jaire Alexander and wide receiver DeAndre Hopkins before landing safety Malaki Starks and edge rusher Mike Green in April’s draft. The result is another talented roster that will enter the year with Super Bowl expectations once again.

Extensions and restructures:

- Signed S Kyle Hamilton to a four-year, $100.4MM contract ($48.02MM guaranteed)

- Signed RB Derrick Henry to a two-year, $30MM extension ($25MM guaranteed)

- Signed WR Rashod Bateman to a two-year, $25MM extension ($16.5MM guaranteed)

- Added $500K of per-game roster bonuses to OLB Kyle Van Noy‘s contract

Extending Henry off his outstanding 2024 season was an early-offseason priority for the Ravens. Saquon Barkley’s market-resetting extension with the Eagles (two years, $41.2MM) seemed to prolong negotiations and increase Henry’s price tag.

Extending Henry off his outstanding 2024 season was an early-offseason priority for the Ravens. Saquon Barkley’s market-resetting extension with the Eagles (two years, $41.2MM) seemed to prolong negotiations and increase Henry’s price tag.

He ultimately signed a two-year extension for $5.6MM less per year than Barkley’s deal; this contract gave the Ravens an out after 2026 if needed. However, Henry shows no sign of slowing down as he entered his 30s. He could see this contract out and retire a Raven. While conventional logic suggests the odds Henry plays out this through-2027 contract are not great — after all, he has a 539-carry lead over the next-closest active running back (Joe Mixon) — but the two-time rushing champion has continued to defy expectations.

The Ravens hedged on Henry last year, bringing him on a two-year deal worth $16MM. That contract gave Baltimore an easy out after Year 1. The Ravens, who pursued Henry in 2023, then watched him dominate to the tune of 1,921 yards and 16 touchdowns. Henry became only the second running back this century to gain at least 1,900 yards and fail to land a first-team All-Pro nod, joining ex-Packer Ahman Green (2003). It took a historic Barkley stampede to deny Henry a second first-team All-Pro honor.

This represents the largest deal for any 30-something running back, highlighting Henry’s longevity and Baltimore’s faith he can keep delivering into his early 30s. The ex-Tennessee mainstay created a historic power-speed combo with Lamar Jackson, and Keaton Mitchell‘s return in earnest from a 2023 ACL tear should only enhance the NFL’s most consistent rushing attack.

The contract guarantees Henry’s 2026 compensation, creating a decision — perhaps for both player and team — in 2027, when the bulldozing RB’s $11MM base salary is nonguaranteed. Already past $74MM in career earnings, the future Hall of Famer will push for $100MM as a result of this extension.

Bateman signed an extension last offseason, partially due to a quirk with his rookie contract. After a career-best year in 2024, he came back for a raise. The Ravens gave him an opportunity to explore his trade market, and the Cowboys inquired before pivoting to George Pickens. But a Bateman-Baltimore pact eventually came together at $12.5MM AAV, still quality value for a receiver of his caliber.

Bateman signed an extension last offseason, partially due to a quirk with his rookie contract. After a career-best year in 2024, he came back for a raise. The Ravens gave him an opportunity to explore his trade market, and the Cowboys inquired before pivoting to George Pickens. But a Bateman-Baltimore pact eventually came together at $12.5MM AAV, still quality value for a receiver of his caliber.

Overall, the agreement brings his terms to just under $50MM over the next five years. The diversity of the Ravens’ offense may cap the 2021 first-rounder’s volume, but he can still be an efficient weapon, especially as one of Jackson’s favorite targets downfield and in the red zone.

Baltimore reportedly explored extensions with a number of their 2022 draftees, including Tyler Linderbaum, Isaiah Likely, and Travis Jones, but they only finalized a pre-Week 1 accord with Hamilton. At $25.1MM per year, Hamilton’s deal dramatically reset the safety market and made him the third-highest-paid defensive back in the league. His AAV represented about 9.0% of the salary cap, similar to the 2022 extension signed by Derwin James after he established himself as the best safety in the league at the time.

Hamilton seems to have done the same. He was a dangerous nickel defender as a rookie before breaking out as a versatile defensive weapon in 2023. In 2024, his move to a more traditional safety role midway through the season revived Baltimore’s pass defense, proving his ability to affect opposing offenses at all levels of the field. Getting the extension done with two years left on Hamilton’s contract will keep him in Baltimore through 2030 for an effective AAV of $20.7MM.

Dating back to Ed Reed‘s dominant run, the Ravens have placed considerable value on safeties. Although this position has seen its value yo-yo in the modern game, Baltimore has kept adding talent here — from Eric Weddle to Earl Thomas to Marcus Williams. Not all of the moves have worked out, but Hamilton is easily the best Ravens safety decision since Reed. This contract reflects a belief Hamilton’s prime will be transformative, as the deal comes in more than $3MM north of where Antoine Winfield Jr. and Kerby Joseph moved the market over the past year-plus.

Dating back to Ed Reed‘s dominant run, the Ravens have placed considerable value on safeties. Although this position has seen its value yo-yo in the modern game, Baltimore has kept adding talent here — from Eric Weddle to Earl Thomas to Marcus Williams. Not all of the moves have worked out, but Hamilton is easily the best Ravens safety decision since Reed. This contract reflects a belief Hamilton’s prime will be transformative, as the deal comes in more than $3MM north of where Antoine Winfield Jr. and Kerby Joseph moved the market over the past year-plus.

Only 24, Hamilton is already a two-time All-Pro. The Ravens locked in some cost certainty by extending Hamilton in his fourth NFL offseason. They did the same with Marlon Humphrey in 2020. Hamilton receives money early as well, and the staggering value convinced the Notre Dame alum to commit ahead of Year 4.

The Ravens, who now have three $20MM-per-year players on defense (in Hamilton, Nnamdi Madubuike and Roquan Smith), were also looking to get ahead of Lamar Jackson’s contract with two $74.5MM cap hits awaiting them in 2026 and 2027, but talks gained little traction. That will likely be Baltimore’s top priority next offseason.

Free agency additions:

- DeAndre Hopkins, WR. One year, $5MM ($5MM guaranteed)

- Cooper Rush, QB. Two years, $6.2MM ($4MM guaranteed)

- Jaire Alexander, CB. One year, $4MM, ($4MM guaranteed)

- Joseph Noteboom, OT. One year, $2MM, ($2MM guaranteed)

- Chidobe Awuzie, CB. One year, $1.255MM ($1.26MM guaranteed)

- John Jenkins, NT. One year, $1.75MM, ($325K guaranteed)

- Jake Hummel, LB. One year, $1.2MM, ($100K guaranteed)

The Ravens have a history of adding Lamar Jackson’s desired receivers. They drafted Marquise Brown on Jackson’s recommendation in 2019 and aggressively pursued Odell Beckham Jr. in free agency in 2023 as they tried to get their franchise QB to sign an extension. This year, DeCosta signed another rumored name on Jackson’s wishlist: Hopkins.

Limited by the Titans’ poor quarterback play last year, Hopkins started to show signs of his former self after being traded to the Chiefs at the deadline. The three-time All-Pro’s $5MM deal features another $1MM in incentives. The Ravens are certainly not adding the Texans’ version of Hopkins, as he has not booked a Pro Bowl invite since 2020 and managed only three catches for 29 yards during the Chiefs’ three-game postseason. But the big-bodied receiver will be positioned as a tertiary target in an offense that has higher-priority players.

Limited by the Titans’ poor quarterback play last year, Hopkins started to show signs of his former self after being traded to the Chiefs at the deadline. The three-time All-Pro’s $5MM deal features another $1MM in incentives. The Ravens are certainly not adding the Texans’ version of Hopkins, as he has not booked a Pro Bowl invite since 2020 and managed only three catches for 29 yards during the Chiefs’ three-game postseason. But the big-bodied receiver will be positioned as a tertiary target in an offense that has higher-priority players.

Hopkins joins Zay Flowers and Rashod Bateman to form a trio pairing youth with experience (and one now housing three first-round picks). The gravity of Baltimore’s rushing game will give Hopkins more one-on-one opportunities to work his veteran route-running and skills at the catch point. The Ravens are hoping Hopkins can be a difference-maker for their offense in key situations. At a minimum, the NFL’s active leader in receiving yards (12,965) would appear to be an upgrade over last year’s WR3, Nelson Agholor.

A longtime backup to Dak Prescott in Dallas, Rush was not seen as a schematic fit behind Jackson. Instead, the team touted his winning record as a starter and veteran experience as reasons he could run the offense if needed. He’s also younger with a more live arm than Josh Johnson, the 2024 backup. Obviously, though, the Ravens will only want Rush on the field if the game is already won in a blowout.

Alexander is known just as much for his talent as his injuries at this point. With only 34 appearances since 2021 – and three seasons with seven games or fewer – the Packers understandably wanted him to take a pay cut from the $17.5MM he was due in 2025. Alexander refused, and his contract remained an obstacle in trade talks with multiple teams, including the Bills. Green Bay eventually cut him loose in June, making the former first-round pick an enticing late addition to the free agency crop.

Alexander is known just as much for his talent as his injuries at this point. With only 34 appearances since 2021 – and three seasons with seven games or fewer – the Packers understandably wanted him to take a pay cut from the $17.5MM he was due in 2025. Alexander refused, and his contract remained an obstacle in trade talks with multiple teams, including the Bills. Green Bay eventually cut him loose in June, making the former first-round pick an enticing late addition to the free agency crop.

The Ravens’ need at cornerback and Alexander’s longstanding friendship with Jackson dating back to their Louisville days made Baltimore an obvious destination. Jackson even told his general manager to “go get” Alexander during a spring press conference. DeCosta obliged, signing Alexander — who also considered the Dolphins and Falcons — just over a week after he hit the market.

As with Hopkins, the Ravens seemed to get a steal by nabbing Alexander for $4MM (plus $2MM in play time incentives), but he still carries significant injury risk. It’s no guarantee the eighth-year vet can stay healthy for a whole season, but he adds another elite talent to a Ravens secondary that was already among the best in the league.

The rest of the Ravens’ free agency signings filled some of the holes in their depth left by their offseason departures. Noteboom arrived as an inexpensive veteran swing tackle to replace Josh Jones. Awuzie was a Titans cap casualty with guaranteed salary remaining on his deal, allowing the Ravens to sign him for the veteran minimum.

The rest of the Ravens’ free agency signings filled some of the holes in their depth left by their offseason departures. Noteboom arrived as an inexpensive veteran swing tackle to replace Josh Jones. Awuzie was a Titans cap casualty with guaranteed salary remaining on his deal, allowing the Ravens to sign him for the veteran minimum.

With 81 career starts, Awuzie is slightly overqualified for a No. 4 CB role. But he has also missed significant time due to injury in two of the past three seasons. The Titans dropped Awuzie’s three-year, $36MM contract after he missed nine games due to a nagging groin injury. This came two years after an ACL tear stalled the ex-Cowboys draftee’s momentum. Having started in Super Bowl LVI with the Bengals, Awuzie was not a full-time starter in his final Cincinnati season. Considering Alexander’s injury history, however, Awuzie could represent important insurance.

Jenkins, who started 34 games for the Raiders in the last two years, will add nose tackle depth behind Travis Jones after Michael Pierce’s retirement in March. Needing to revamp an underwhelming special teams unit, the Ravens added former Rams special teams ace Jake Hummel on a cheap deal.

Re-signings

- Ronnie Stanley, LT. Three years, $60MM ($44MM guaranteed)

- Patrick Ricard, FB. One year, $2.873MM, ($2.87MM guaranteed)

- Tylan Wallace, WR. One year, $2.1MM ($1.35MM guaranteed)

- Ar’Darius Washington, S. One year, $3.26MM (RFA tender)

- Ben Cleveland, RG. One year, $1.17MM

The No. 6 pick in the 2016 draft, Stanley is coming off a resurgent year — his best since a devastating ankle injury in 2020. The nine-year Baltimore left tackle only played 25 games in the next three seasons and couldn’t return to his elite form even when he was healthy. The Ravens stood by Stanley (and his massive contract), but they got him to take a pay cut in 2024 to ease their cap burden and prove that he was back to full health.

The No. 6 pick in the 2016 draft, Stanley is coming off a resurgent year — his best since a devastating ankle injury in 2020. The nine-year Baltimore left tackle only played 25 games in the next three seasons and couldn’t return to his elite form even when he was healthy. The Ravens stood by Stanley (and his massive contract), but they got him to take a pay cut in 2024 to ease their cap burden and prove that he was back to full health.

The nine-year veteran responded with the first full season of his career as well as his second Pro Bowl selection. Stanley wasn’t a dominant pass protector, but he lost slowly and consistently gave Jackson enough time to make a play. He also played a huge role in the Ravens’ bulldozing rushing offense leading runs to the weak side that regularly gashed opposing defenses.

As a result, Stanley wasn’t just the Ravens’ biggest pending free agent, but one of the most coveted league-wide. PFR’s No. 4-ranked free agent, Stanley drew significant interest from the Patriots, Chiefs, and Commanders, but he took $20MM per year to stay in Baltimore. The Ravens convinced Stanley to re-sign two days before the legal tampering period.

Offseason In Review: Washington Commanders

Making one of the more stunning conference championship game journeys in NFL history, the Commanders altered their trajectory in the first year of the Adam Peters–Dan Quinn regime. Although early-career QB promise has fooled this franchise in the past, Jayden Daniels looks to have solved one of the NFL’s longeststanding position issues. The 2024 Offensive Rookie of the Year gives Washington hope, as evidenced by the team’s (convincing) upset win over the No. 1-seeded Lions in the divisional round.

Sustaining that promise will not be easy, but the Commanders went to work on filling their roster with veteran talent to complement Daniels’ rookie contract. This formula has paid off big for teams in the rookie-scale contract era, and the Commanders will take their swing. Laremy Tunsil and Deebo Samuel are in the nation’s capital to help, and the Daniels-centered roster is now flanked by a host of experienced veterans.

Extensions and restructures:

- Reached three-year, $87MM ($44.65MM guaranteed) extension with WR Terry McLaurin

- Agreed to two-year, $3.35MM extension with DB Jeremy Reaves

- Extended S Percy Butler on one-year, $5.56MM deal ($3.41MM guaranteed)

- Reduced Andrew Wylie‘s pay; OL now tied to one-year, $4MM deal ($3.5MM guaranteed)

Washington has been unable to find a viable McLaurin sidekick, striking out in free agency and on first-round pick Jahan Dotson. McLaurin, however, continued to produce regardless of the overmatched quarterbacks the franchise trotted out from 2019-23. Regardless of the value displayed during his career, McLaurin ran into some obstacles with Adam Peters embroiled in his first major extension talks as GM.

Washington has been unable to find a viable McLaurin sidekick, striking out in free agency and on first-round pick Jahan Dotson. McLaurin, however, continued to produce regardless of the overmatched quarterbacks the franchise trotted out from 2019-23. Regardless of the value displayed during his career, McLaurin ran into some obstacles with Adam Peters embroiled in his first major extension talks as GM.

Upon drafting Daniels, the Commanders continued to lean on McLaurin, who continued his run of durability and delivered another solid season. McLaurin’s 1,096 yards were not a career high; his 13 touchdown catches were. And he added three more scores in the playoffs, cementing a second extension candidacy.

Entering the offseason tied to his 2022 deal, McLaurin also approaches an age-30 season — which became a point of contention during a long-running set of negotiations. While fellow 2019 Day 2 wideouts A.J. Brown and D.K. Metcalf had third contracts in place, both players are two years younger than McLaurin. The Ohio State product being Washington’s top weapon throughout his career counted for plenty, but this became a difficult negotiation. Drafted during the Bruce Allen regime’s final offseason, McLaurin ran into trouble convincing the Peters-led front office of his value this year.

In the Amari Cooper boat as a perennial 1,000-yard receiver but one never especially close to the league lead, McLaurin carries a bit more of an alibi due to the likes of Taylor Heinicke, Dwayne Haskins and Sam Howell being his primary passers. With Case Keenum and Carson Wentz sprinkled in, McLaurin doing enough to assemble a five-season streak of that sort is impressive. And Metcalf was less consistent despite having better QB play in Seattle. Still, this Commanders regime held McLaurin’s age against him.

In the Amari Cooper boat as a perennial 1,000-yard receiver but one never especially close to the league lead, McLaurin carries a bit more of an alibi due to the likes of Taylor Heinicke, Dwayne Haskins and Sam Howell being his primary passers. With Case Keenum and Carson Wentz sprinkled in, McLaurin doing enough to assemble a five-season streak of that sort is impressive. And Metcalf was less consistent despite having better QB play in Seattle. Still, this Commanders regime held McLaurin’s age against him.

Not reporting to OTAs or minicamp, McLaurin soon expressed frustration about the tenor of his second round of extension talks. The Commanders were surprised by how difficult the talks were proving to be, but the receiver market had shifted considerably over the past two offseasons.

Washington’s Ron Rivera–Martin Mayhew brass extended McLaurin — on a three-year, $69.6MM deal — during the 2022 WR market boom, but that deal preceded those given to Metcalf and Deebo Samuel. With Garrett Wilson‘s Jets accord moving the $30MM-per-year WR club to nine, it is unsurprising the top Washington pass catcher wanted in. Despite McLaurin’s importance to the team, the Commanders preferred his deal land south of that point.

McLaurin held out before quickly reporting to camp and shifting to an injury-based hold-in. A July 31 trade request emerged, and the Patriots — as they have been with just about every potentially available wideout over the past two years — were interested. Even after the Commanders activated the seventh-year veteran from their active/PUP list, he was not doing team drills. Unlike Micah Parsons or even Trey Hendrickson, no real possibility existed of a Commanders trade. But a future in which McLaurin played out his 2022 extension —  ahead of a possible 2026 franchise tag — was in play.

ahead of a possible 2026 franchise tag — was in play.

Finding a compromise at $29MM per year, the sides agreed to terms on a deal that placed McLaurin 10th in receiver AAV. This landed him south of where Wilson and Metcalf settled this offseason but above the Tee Higgins and Jaylen Waddle WR2 deals. The Commanders guaranteed McLaurin’s compensation through 2026, but an out is in place by March 2027. On April 1, 2027, McLaurin will see $5.35MM of his $23.3MM 2027 base salary become guaranteed, per Spotrac. There are $2.05MM in incentives in each year of the deal.

After two seasons as a starter, Wylie accepted a reduction in the final year of his contract. Given a three-year, $24MM deal to follow ex-Chiefs OC Eric Bieniemy to Washington in 2023, Wylie started 29 Commanders games since. Wylie’s guard past in Kansas City is expected to come in handy early, with Sam Cosmi out to open the season, but the 2024 extension recipient’s return will bump the veteran to the bench.

Trades:

- Acquired LT Laremy Tunsil, No. 128 from Texans for Ns. 79, 236, 2026 second-, fourth-round picks

- Added WR Deebo Samuel from 49ers for No. 147

- Traded RB Brian Robinson to 49ers for 2026 sixth-round pick

The Commanders’ tackle equation changed significantly this offseason, leading Wylie and primary 2024 left guard starter Nick Allegretti to the bench (once Cosmi recovers). Step one in that process involved another Tunsil trade. The Texans had extended Tunsil twice during his six-season stay but were not ready to discuss a third contract. Nearly six years after Houston gave up two first-round picks in a megadeal with Miami, Tunsil still fetched four draft choices to change teams.

The Commanders’ tackle equation changed significantly this offseason, leading Wylie and primary 2024 left guard starter Nick Allegretti to the bench (once Cosmi recovers). Step one in that process involved another Tunsil trade. The Texans had extended Tunsil twice during his six-season stay but were not ready to discuss a third contract. Nearly six years after Houston gave up two first-round picks in a megadeal with Miami, Tunsil still fetched four draft choices to change teams.

While the Texans did not field a good offensive line in 2024, Tunsil was their most talented option. The team unloaded the Pro Bowl mainstay anyway, shaking things up ahead of C.J. Stroud‘s third season. They found another team with a rookie-deal QB to take the 10th-year veteran, and the final two years on Tunsil’s contract overlap with Jayden Daniels‘ two remaining rookie-pact seasons.

If Washington does not extend Tunsil — and no substantial talks have occurred — the overlap with Daniels’ rookie deal represents nice balance. Tunsil, 31, has proven a shrewd negotiator. If no talks take place early next offseason, drama should be expected.

Tunsil has played at least 14 games in eight of his nine seasons, only missing significant time during a woeful 2021 Texans season. He suited up for every Houston contest last year, ranking 10th among tackles in pass block win rate. Pro Football Focus viewed Tunsil as a top-20 tackle in each of his past two seasons. He will provide the Commanders with a considerable upgrade from Coleman and Cornelius Lucas.

Tunsil has played at least 14 games in eight of his nine seasons, only missing significant time during a woeful 2021 Texans season. He suited up for every Houston contest last year, ranking 10th among tackles in pass block win rate. Pro Football Focus viewed Tunsil as a top-20 tackle in each of his past two seasons. He will provide the Commanders with a considerable upgrade from Coleman and Cornelius Lucas.

As a result of the trade, Coleman shifted away from left tackle but is on track to take over at left guard. The 2024 third-round pick is in front of Allegretti, another ex-Chief. Allegretti and Wylie are likely to be experienced bench cogs once Cosmi returns from his ACL tear.

Two seasons remain on Allegretti’s three-year, $16MM accord, while Coleman has three years remaining on his rookie deal. Coleman (12 rookie-year starts) was mentioned as a right tackle candidate ahead of the Josh Conerly Jr. draft choice before sliding into the guard mix. Coleman started eight games at guard for TCU in 2021, a period that should help his transition.

Prior to the costlier Tunsil trade, the Commanders turned to Peters’ former team for a long-overdue McLaurin wingman. Samuel will attempt to reignite his career in Washington, as the versatile playmaker could not live up to his 49ers contract. Piggybacking on McLaurin’s 2022 terms, Samuel signed a three-year, $71.55MM extension weeks later that summer. The former second-round pick was coming off a first-team All-Pro season. Unfortunately for Samuel and the 49ers, he has not approached that 2021 showing since.

Still a valuable piece in Brock Purdy‘s four-All-Pro skill-position fleet, Samuel had a productive year in 2023 (892 receiving yards, 225 rushing yards, 12 total TDs). And he has only missed three games due to injury over the past two seasons. In 2024, however, Samuel only totaled 670 receiving yards and saw his yards per carry — a stat pretty much applicable to only one active NFL wideout — drop from 6.1 in 2023 to 3.2 in ’24.

Still a valuable piece in Brock Purdy‘s four-All-Pro skill-position fleet, Samuel had a productive year in 2023 (892 receiving yards, 225 rushing yards, 12 total TDs). And he has only missed three games due to injury over the past two seasons. In 2024, however, Samuel only totaled 670 receiving yards and saw his yards per carry — a stat pretty much applicable to only one active NFL wideout — drop from 6.1 in 2023 to 3.2 in ’24.

Samuel derives part of his value from the “wide back” job description, but 202 career carries (plus 52 more playoff totes) may make him — in boxing parlance — an old 29. He is undoubtedly an upgrade on what Washington was deploying opposite McLaurin last season, and Kliff Kingsbury should have some good concepts ready for usage following this trade. But this was effectively a 49ers salary dump.

The Broncos and Texans showed interest, but neither team made an offer. The Commanders had been mentioned as a Cooper Kupp suitor via trade, but they had already pulled the trigger on Samuel when the Rams cut him.

Although Samuel saw his new team fully guarantee his 2025 compensation ($17MM) in a summer transaction, that was a misleading gesture due to the WR/RB’s vested-veteran status requiring that amount become guaranteed in early September. Samuel is still in a contract year, and this season figures to determine if another lucrative multiyear deal will be in play for the 2019 second-round pick. If the Commanders do not re-sign Samuel by the 2026 league year, they will be hit with $12.34MM in dead money due to void years.

Offseason In Review: Kansas City Chiefs

The only team to advance to five Super Bowls in six years, the Chiefs continued their dynasty but saw the Eagles’ blowout win deny them a threepeat. Kansas City’s metrics and point differential last season pointed to a record far worse than 15-2, but the team still managed to skate to Super Bowl LIX. After Philadelphia exposed the 2024 K.C. edition’s flaws, the Chiefs — like they did after their Super Bowl LV loss to the Buccaneers — went to work addressing them.

Changing up along their offensive line once again, the Chiefs added two left tackle options and swapped out Joe Thuney‘s big-ticket deal for a Trey Smith payday. The team’s latest high-profile suspension (for wide receiver Rashee Rice) will impact the start of its latest AFC title defense, and there is no shortage of challengers heading into the season. But the Chiefs still roll out the Patrick Mahomes–Travis Kelce–Chris Jones troika that, along with Andy Reid, created this dynasty. The team worked on the future Hall of Famers’ supporting cast this offseason.

Extensions and restructures:

- Reached four-year, $94MM extension ($46.75MM guaranteed) with franchise-tagged G Trey Smith

- Agreed on four-year, $88MM extension ($32MM guaranteed) with DE George Karlaftis

- Restructured QB Patrick Mahomes, DT Chris Jones‘ contracts, creating $49.4MM in cap space

Paying Creed Humphrey a center-record deal last year, the Chiefs were unable to come to terms with Smith. That led to a $23.4MM franchise tag. For a while, it appeared the team would let Smith walk in free agency as it had Orlando Brown Jr. But Smith’s age made him a player the franchise would do what it needed to in order to retain. This space pondered what was effectively a Thuney-for-Smith payroll swap last year; not long after Super Bowl LIX, the Chiefs executed the switch. Thuney’s move to Chicago came days after the Smith franchise tag, and the Chiefs are now committed to the former sixth-round find.

Prioritizing interior protection for Mahomes during a 2021 offseason that saw the arrivals of Thuney, Humphrey and Smith, the Chiefs have now reset the guard market twice in the past five offseasons. They gave Thuney a five-year, $80MM deal in March 2021; the cap having spiked by $97MM since made Smith’s market more lucrative. He ended up becoming the first guard to exceed $21MM per year and did so by a healthy margin. Smith, 26, enters this season with a $23.5MM AAV.

Prioritizing interior protection for Mahomes during a 2021 offseason that saw the arrivals of Thuney, Humphrey and Smith, the Chiefs have now reset the guard market twice in the past five offseasons. They gave Thuney a five-year, $80MM deal in March 2021; the cap having spiked by $97MM since made Smith’s market more lucrative. He ended up becoming the first guard to exceed $21MM per year and did so by a healthy margin. Smith, 26, enters this season with a $23.5MM AAV.

Teams rarely use franchise tags on interior offensive linemen. That brought a complication for the Chiefs, as the CBA groups all O-linemen together under the tag and fifth-year options formulas. Since 2012, Thuney, Smith and Brandon Scherff have been the only guards tagged. The Chiefs tagging Smith helped the guard market climb, as the Tennessee alum being grouped with tackle salaries on the tag inflated the tender price. Smith signed his tender soon after, making this a rather peaceful negotiation. It still took a while for a deal to be struck.

Although only two players (Smith and Tee Higgins) were tagged this year, the Chiefs still injected some old-school drama into the July tag deadline. They reached an extension with their Pro Bowl right guard hours before the July 15 deadline. This came three Julys after they failed to extend Brown, creating a left tackle revolving door. A question about Kansas City’s LG position now exists, but the team is set on the other side.

Pro Football Focus has graded Smith as a top-15 guard in each of his four seasons, while ESPN ranked him sixth among interior blockers in run block win rate last year and fourth in pass block win rate in 2024. Blood clots in Smith’s lungs caused his draft stock to crater in 2021, but the Chiefs hit big on the No. 226 overall pick that year.

Pro Football Focus has graded Smith as a top-15 guard in each of his four seasons, while ESPN ranked him sixth among interior blockers in run block win rate last year and fourth in pass block win rate in 2024. Blood clots in Smith’s lungs caused his draft stock to crater in 2021, but the Chiefs hit big on the No. 226 overall pick that year.

Smith earned fully guaranteed 2025 and ’26 compensation, but like their Jawaan Taylor deal, the Chiefs built in a rolling guarantee structure to complete this deal. Smith’s $23.25MM 2027 base salary locks in on Day 3 of the ’26 league year, effectively tying him to the Chiefs for at least three more seasons. Smith’s consistency points to this partnership having a chance to last longer.

Months later, Kansas City completed a quieter negotiation with Karlaftis. Not part of the Tyreek Hill trade package (like Trent McDuffie was), Karlaftis went 30th overall in 2022. The Purdue product has been a steady producer on a Chris Jones-fronted D-line over the past three years. After a 10.5-sack 2023 season, Karlaftis smashed his career high in QB hits by tallying 28 in 2024. This body of work prompted the Chiefs to act early on a player without a Pro Bowl nod.

Because Karlaftis has not hovered especially close to the best at his position, the Chiefs completed a rare middle-class extension with a player paid early. Karlaftis became the third Chiefs player in the fifth-year option era to sign an extension in the same offseason his option was exercised, joining Mahomes (2020) and Eric Fisher (2016). Despite the EDGE market exploding this offseason, it took a deal that ended up less than halfway to Micah Parsons‘ record-setter ($46.5MM per year) to lock in Karlaftis through 2030.

Because Karlaftis has not hovered especially close to the best at his position, the Chiefs completed a rare middle-class extension with a player paid early. Karlaftis became the third Chiefs player in the fifth-year option era to sign an extension in the same offseason his option was exercised, joining Mahomes (2020) and Eric Fisher (2016). Despite the EDGE market exploding this offseason, it took a deal that ended up less than halfway to Micah Parsons‘ record-setter ($46.5MM per year) to lock in Karlaftis through 2030.

The Chiefs inked their Karlaftis extension days before T.J. Watt moved the market once again. While Karlaftis was never a candidate to land a near-top-market accord, Kansas City getting in ahead of the Watt and Parsons windfalls represented good timing. This deal reminds of the Bills’ March Gregory Rousseau extension (4/80), and when the dust settled, Karlaftis is the NFL’s 13th-highest-paid edge rusher. The Chiefs topping the payments for Rousseau, Josh Sweat and 2024 Pro Bowl starter Jonathan Greenard illustrates the workmanlike D-end’s importance on their roster.

Trades: